Dear teams, clients, and friends of Fourthline,

This past year, businesses and consumers alike were hit with a wave of surprises that forced us into a new, digital-first way of living, working, and managing money. Meanwhile, the banking industry was hit with a surprise of its own: a surge in financial crime on a global level, costing upwards of $2.2 billion in attempted fraud losses. Not only are identity theft and money laundering growing at an alarming rate, but fraudulent attempts are becoming more complex and more sophisticated.

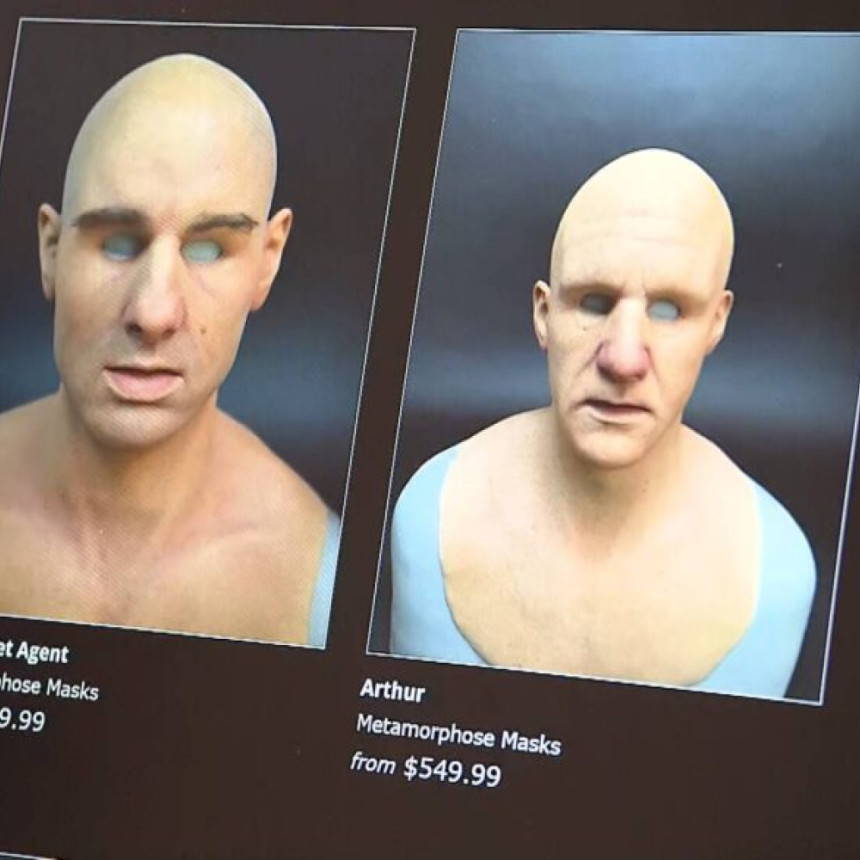

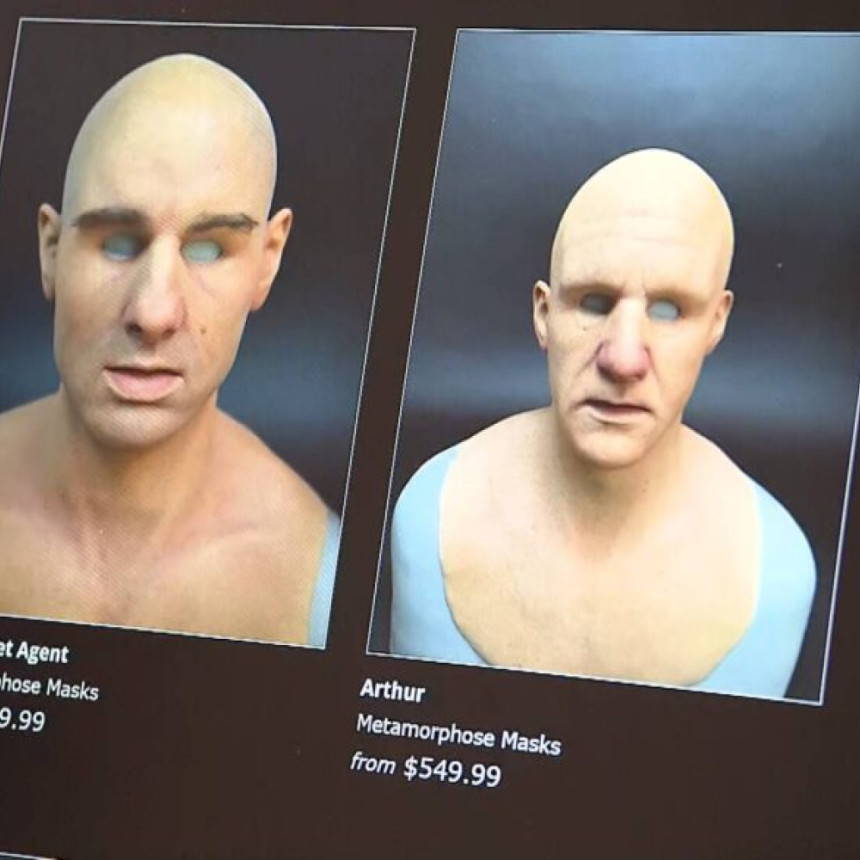

In this new article I authored for Biometric Update, ‘The fraudster’s new game face’, I discuss the surprising methods fraudsters are now using and what steps the industry should take to protect itself. Please give it a read and reach out to the Fourthline team to discuss how we can equip you with the ID verification and KYC solutions needed to safeguard your business.

Fourthline Head of Anti-Financial Crime, Ro Paddock