If you could imagine the perfect way for a financial institution or fintech to manage AML and stay on the right side of regulations, it would probably involve being able to automate the process of ensuring customers are not on any sanctions lists.

In this ideal situation, these automated checks would be reliable and highly accurate, and while edge cases would inevitably exist, manual work would be minimal. With this kind of situation, financial institutions would benefit from:

- maintaining compliance with regulations,

- lower overheads (due to fewer resources needed to screen customers and no fines),

- improved reputations (due to never being on the wrong side of regulations).

The problem: A lack of data and automation makes AML slow and expensive

Sadly, this ideal scenario is rarely the case today.

The information financial institutions have on their customers is frequently limited to a small number of key data points, including name, official ID, date of birth, and sometimes other information such as address, or phone number. This means that when sanctions lists are updated, you will likely find a number of partial matches within your customer base. You then need to deploy resources to investigate if the partial match is a false positive, or is indeed a sanctioned individual.

The pros and cons of a typical AML screening tool

Often, adopting an AML screening tool can look like an attractive way to minimize the volume of manual work needed to reach a conclusion as to whether a partial hit is a sanctioned individual.

Typical AML screening tools promise to save you time and money by automating your investigation into whether or not a possible match between a sanctions list and your customer is real or a false positive. Many of them do so using a combination of your data and their own.

However, rather than provide you with a conclusive outcome as to whether the match is true, most screening tools will stop short, and provide only a “likely outcome.” This means that you still need to invest your own valuable time and resources to further investigate, and make a conclusive decision about the individual.

Other challenges in working with third party AML screening tools

Further, if you are an enterprise such as a bank, working with third party screening tools is difficult even if they are effective. Among other things, you need to consider the risks of outsourcing a critical functionality that sits at the heart of compliance and your reputation, and that the solution in question has the right functionality and stability.

Ultimately, this means you are faced with an unsatisfactory situation where ensuring none of your customers are on dynamic sanctions lists is a big, but necessary cost of doing business. And even if you employ third-party screening solutions, you still need to do a lot of the heavy lifting yourself when it comes to identifying potentially sanctioned customers.

Conclusive outcomes accelerate your AML processes and save money

To reduce the burden of AML compliance, what financial institutions need is not “likely outcomes” from their screening tools, but conclusive outcomes.

With conclusive outcomes, you can achieve:

-

drastically reduced overheads associated with manually checking potentially sanctioned customers,

- a better relationship with regulators, including a reduced risk of paying expensive fines,

- an improved reputation and greater level of trust from your customers.

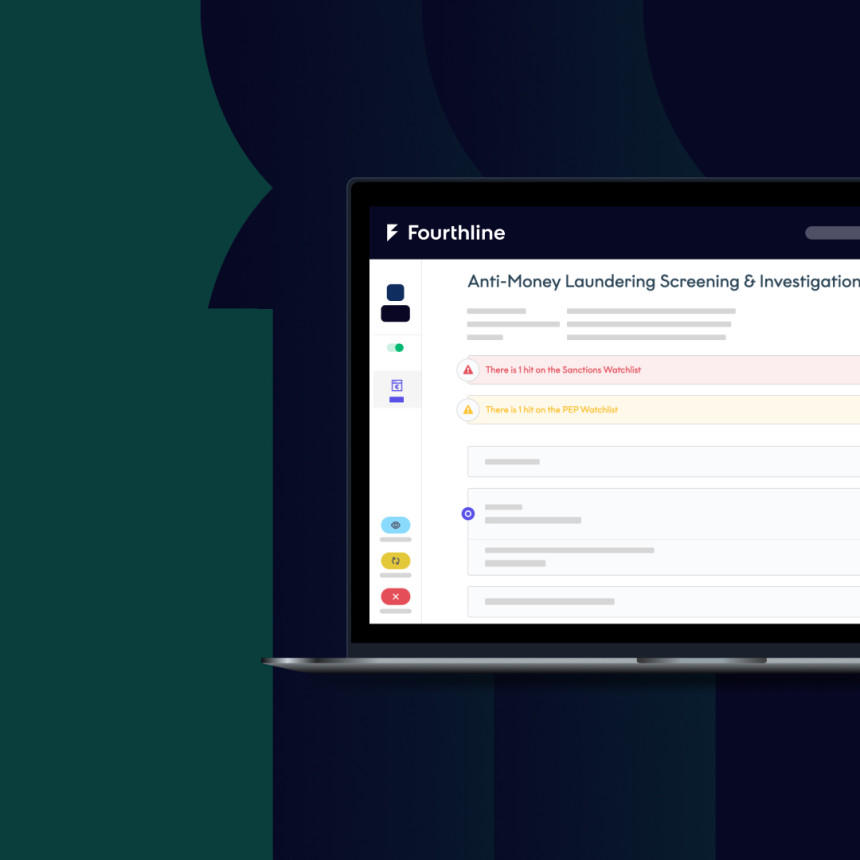

This is where Fourthline’s AML screening solution steps in. Where AML screening in the above scenarios is fragmented, with multiple steps and points of failure, our AML screening is unique in that it provides a conclusive outcome in almost all cases, speeding up your process, and drastically reducing complexity and risk of error.

It does this through checking eight data points including Name, Age, Gender, Date of Birth, Location/Address, Nationality, and Place of Birth. These data points are used to determine the risk score of the screened person, and show whether it is a false positive or a confirmed hit. Potential hits are then quickly investigated by Fourthline, requiring no action from your in-house team. Fourthline then shares a Client Due Diligence (CDD) report complete with an audit trail including all the evidence that led to the conclusion.

A modular solution to plug into your existing stack

Most financial institutions would jump at the opportunity to have automated, accurate, conclusive outcomes from their AML screening solution. However, there are always more considerations, including the above-mentioned risks of outsourcing critical compliance functionality, putting too much responsibility into the hands of one vendor, and so on.

To provide banks and other financial institutions with the flexibility they need to test new business-critical software in their existing stacks, Fourthline AML screening is an API-based modular solution that can be plugged into an existing system quickly and easily. This gives you a low threshold for adoption and a great deal of flexibility in terms of how it is used alongside other tools.

Test it on your own data now with a free demo

Today, the way AML compliance is practiced by the vast majority of financial institutions is slow, expensive, and involves an unnecessary volume of manual work. Yet solutions promising automation also fall short in terms of providing conclusive advice on whether a partial hit is indeed a sanctioned individual or merely a false positive.

With our AML screening solution, you have a low-threshold way to automate your AML screening processes, save time and money, and improve the quality of your AML screening outcomes. In fact, you are able to test the solution on a sample of your own data for free, and compare the accuracy of the results, and improved speed and convenience with your current processes, to see if it is a suitable fit for your organization.

To find out more or book a demo, contact us.