Mar 13, 2025

Shine: Accelerating SME Banking Access in France

The Fourthline Team

A Case Study in Fast and Flexible Integration

Shine is a leading fintech in France belonging to Ageras, which operates throughout Europe focused on supporting small businesses and self-employed workers with accounting software, business banking and admin tools. As a payment institution, Shine adheres to the rigorous regulatory standards applicable to such institutions.

Shine is dedicated to perfecting their product for the domestic market — which meant finding a security partner well-versed in tackling local compliance and regulatory challenges specific to French small and medium-sized enterprises.

In 2023, Shine teamed up with Fourthline to build a future proof identity verification platform.

In this article, we’ll take a closer look at how this partnership came together — and how Fourthline can help your business with similarly fast and flexible integrations.

A Customer-First Approach to ID Verification

Rapid growth is built into the startup model. But for the folks at Shine, growth only makes sense if it helps the hard-working entrepreneurs they serve.

What did this mean for Shine’s digital identity partnership with Fourthline?

It meant developing a solution that could improve the user experience for French customers while meeting the requirements of French regulators. And it meant doing it fast — the speed at which Shine was taking on new customers didn’t allow for lengthy delays.

Fourthline’s team needed eight weeks to go live with a comprehensive customer onboarding system featuring:

ID and verification

QES (Qualified Electronic Signature)

Real-time fraud detection

A seamless, mobile-first user experience

Even more impressive than the timeline is how we built it, flexibly adding on new features to improve the user experience for Shine’s customers even after the initial go-live date.

‘Flexible’ Means Keeping One Eye on the Future

Shine has continued to grow rapidly since adding Fourthline’s “base package” ID verification toolkit. And thanks to our Modular Identity Platform, they’ve been able to quickly add additional features as it has made sense for their business.

This flexibility is a key aspect of Shine’s success story. Following the initial platform integration, Shine has added on:

A Qualified Electronic Signature (QES) flow, which onboards clients without compromising on user experience, conversion rates, or peak performance

Tools for developers to integrate their service into mobile applications

With more than 120,000 business owners now using Shine to grow and manage their money across France, it may seem like Shine’s story has come to a happy conclusion.

But there’s a whole continent of opportunity left to explore: Shine now belongs to Ageras, which supports small businesses in Germany, the Netherlands, Denmark, and France—its core markets.. Thanks to Fourthline's flexible identity platform — with features that adapt to new security threats as they arise — this adventure might just start.

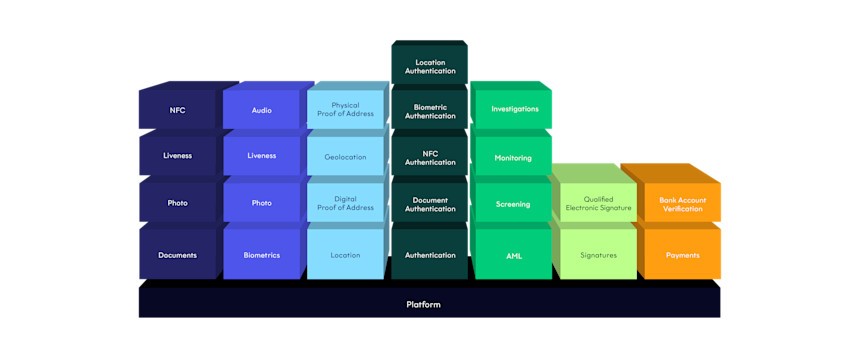

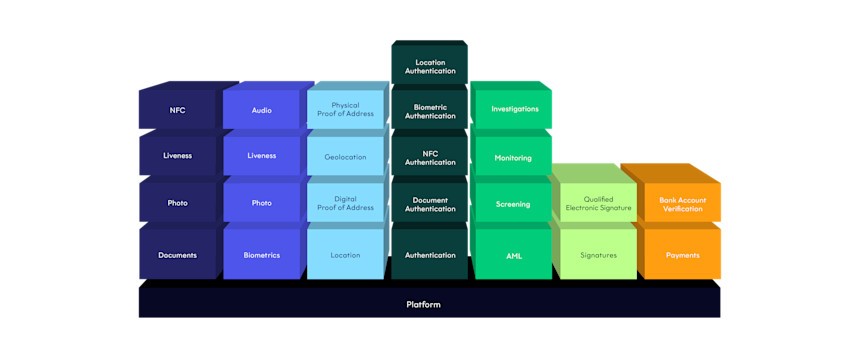

A Modular Platform That Grows with Our Partners

From standard Identity Verification to bank-grade, remediation, & AML Screening, Fourthline’s platform provides the plug-and-play features needed to verify identities and comply with local regulations.

Want to learn more?

Discover how we can help you solve mission-critical identity challenges in a tailored way.

A Case Study in Fast and Flexible Integration

Shine is a leading fintech in France belonging to Ageras, which operates throughout Europe focused on supporting small businesses and self-employed workers with accounting software, business banking and admin tools. As a payment institution, Shine adheres to the rigorous regulatory standards applicable to such institutions.

Shine is dedicated to perfecting their product for the domestic market — which meant finding a security partner well-versed in tackling local compliance and regulatory challenges specific to French small and medium-sized enterprises.

In 2023, Shine teamed up with Fourthline to build a future proof identity verification platform.

In this article, we’ll take a closer look at how this partnership came together — and how Fourthline can help your business with similarly fast and flexible integrations.

A Customer-First Approach to ID Verification

Rapid growth is built into the startup model. But for the folks at Shine, growth only makes sense if it helps the hard-working entrepreneurs they serve.

What did this mean for Shine’s digital identity partnership with Fourthline?

It meant developing a solution that could improve the user experience for French customers while meeting the requirements of French regulators. And it meant doing it fast — the speed at which Shine was taking on new customers didn’t allow for lengthy delays.

Fourthline’s team needed eight weeks to go live with a comprehensive customer onboarding system featuring:

ID and verification

QES (Qualified Electronic Signature)

Real-time fraud detection

A seamless, mobile-first user experience

Even more impressive than the timeline is how we built it, flexibly adding on new features to improve the user experience for Shine’s customers even after the initial go-live date.

‘Flexible’ Means Keeping One Eye on the Future

Shine has continued to grow rapidly since adding Fourthline’s “base package” ID verification toolkit. And thanks to our Modular Identity Platform, they’ve been able to quickly add additional features as it has made sense for their business.

This flexibility is a key aspect of Shine’s success story. Following the initial platform integration, Shine has added on:

A Qualified Electronic Signature (QES) flow, which onboards clients without compromising on user experience, conversion rates, or peak performance

Tools for developers to integrate their service into mobile applications

With more than 120,000 business owners now using Shine to grow and manage their money across France, it may seem like Shine’s story has come to a happy conclusion.

But there’s a whole continent of opportunity left to explore: Shine now belongs to Ageras, which supports small businesses in Germany, the Netherlands, Denmark, and France—its core markets.. Thanks to Fourthline's flexible identity platform — with features that adapt to new security threats as they arise — this adventure might just start.

A Modular Platform That Grows with Our Partners

From standard Identity Verification to bank-grade, remediation, & AML Screening, Fourthline’s platform provides the plug-and-play features needed to verify identities and comply with local regulations.

Want to learn more?

Discover how we can help you solve mission-critical identity challenges in a tailored way.

Solutions

Solutions

Fourthline has been certified by EY CertifyPoint to ISO/IEC27001:2022 with certification number 2021-039.

Copyright © 2026 - Fourthline B.V. - All rights reserved.

Fourthline has been certified by EY CertifyPoint to ISO/IEC27001:2022 with certification number 2021-039.

Copyright © 2026 - Fourthline B.V. - All rights reserved.