Aug 6, 2021

Traditional Proof-of-Address Checks Are Ineffective: Here’s How To Protect Your Business

Jesse Weststrate - Head of Product

Proof-of-Address (PoA) is one of the core verifications in any onboarding process. The concept is simple: verify that a user lives at the permanent address claimed.

Traditionally, to meet the PoA requirement the end customer must submit official documents that state their name and place of residency during the application process. Accepted documents include utility bills and bank or credit card statements, which must be dated within three months of the application date.

It seems straight forward, except for a major flaw in this traditional PoA approach: these documents are not designed to deter fraud. They have no security features and are easy to falsify.

Furthermore, the range of documents that can be provided for PoA and the variations in formats of those documents (between country, municipality, and city) make managing them a huge administrative burden on the back-office teams handling them. And it’s not only a time consuming and frustrating process for the client: most end customers do not have PoA documents readily available in the sign-up process, causing significant delays and ultimately reducing customer conversions.

Turning the manual process of checking off boxes into a valuable fraud prevention tool

While Fourthline's KYC and ID verification solutions can support the collection and analysis of any of these document types, we encourage clients to focus on the objectives they’ve set for capturing this data and assess whether current practices are actually fulfilling them.

To solve for this challenge, we’ve designed a proprietary fraud detection solution: Fourthline's geolocation and metadata analysis module, creating a more reliable and customer-centric alternative to PoA checks.

Despite concerns surrounding the effectiveness of current Proof-of-Address procedures, a PoA check must still be performed in order to comply with AML regulations. Fourthline offers its own PoA module, which is not only faster and easier for the end customer than the traditional approach but also far more advanced in its application. Instead of being a manual process of checking off boxes, our PoA module provides a valuable and reliable fraud prevention tool for our clients.

Our device metadata and geolocation module incorporate a four-tier PoA check:

Caught in the act: examples of fraud

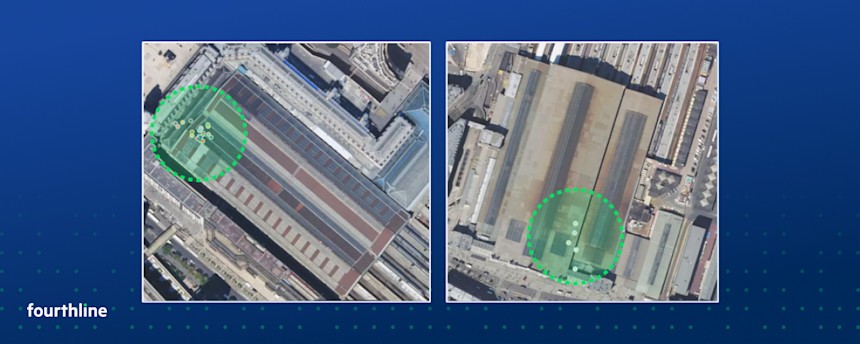

The following fraud example was caught by Fourthline based on device geolocation (the users’ physical location during the initial sign up.) The below image shows that a cluster of individuals are attempting to sign up for multiple accounts at two train stations within the same city. The number of attempted sign ups within a short time period and within a non-residential location, raises red flags.

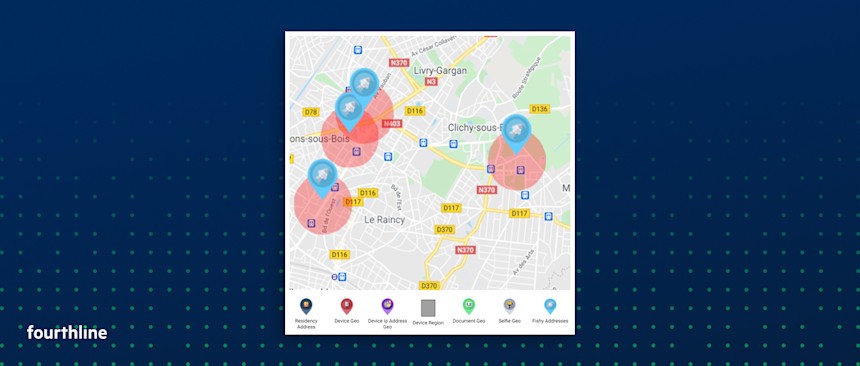

When it comes to fraud hotspots and suspcious addresses, the below snapshot shows Fourthline's data in action: indicating "fishy" locations that are confirmed sites for fradulent activity.

How does it work?

On the front end, the customer agrees to share their device location data with Fourthline (satisfying GDPR requirements). This allows us to retrieve all the data we need to perform the above checks, in a matter of seconds.

Using all the above inputs, Fourthline can create a detailed overview of the end user, visualizing the consistency of data by extracting and comparing these visible and invisible data points. This results in:

A fast and customer-friendly experience: efficient customer onboarding in just a matter of seconds.

Stronger conversion rates for our clients: while the PoA stage is a typical drop-off point for end customers, Fourthline achieves a 99.7% conversion rate overall with only 0.3% failing at the address verification stage.

Increased fraud detection: this method is more detailed and enables our client to achieve industry-leading fraud detection levels.

Unlike traditional PoA checks, the benefits of the geolocation module do not stop at the onboarding stage. Fourthline helps clients prevent an additional 20-30% of fraudulent activity through ongoing monitoring after the initial onboard that will reveal any geolocation anomalies going forward.

At Fourthline, we work hard to future-proof our ID verification and KYC capabilities so they can keep pace with the changing world of financial crime. Want to learn more about our PoA solution? Please email us at info@fourthline.com or go to ‘contact sales’ on the website.