Mar 20, 2024

How to navigate crypto regulations with Fourthline: Spotlight on MiCA

The Fourthline Team

Learn more here

Bitcoin's price continues to crush historical records, and investors' interest is growing exponentially, with the new spot ETFs attracting billions in investments. This has created a feeling that, after two turbulent years of scandals, hacks, and thefts, the industry has finally moved on.

However, "this time it is different" is the most dangerous phrase in the financial world and recent developments prove it. In February, a decentralized and non-KYC crypto exchange was hacked, losing 409 BTC and 1,728 ETH.

The situation is a timely reminder that while the crypto world is gradually moving towards greater institutionalization, with traditional financial players entering the market, the cybercrime risk isn't going away. Moreover, the regulatory hold is getting stronger, with new rules set to come into force in the EU in a bid to ensure a healthier and more stable environment.

In light of that, CEOs and compliance officers of crypto-engaged companies now have one key priority - to find the right compliance partner to help them prepare for the upcoming regulations and ensure the adequate protection of their operations and clients. More importantly - one that won't burden them with unnecessarily high compliance costs, hindering their growth plans, or sacrificing operational agility.

Crypto regulation in Europe: Breaking down the Markets in Crypto Assets (MiCA) regulation

The Markets in Crypto Assets (MiCA) regulation will make the European Union the world’s first major jurisdiction with a comprehensive and tailored law for crypto assets. The regulation will cover crypto assets that don’t fall under the scope of existing financial industry legislation.

MiCA will emulate many of the rules used within the financial industry (e.g., to prevent insider trading, curb market abuse, provide investors with white papers similar to security prospectuses, etc.). However, European regulators won’t try to shoehorn cryptocurrencies into existing regulations. Just the opposite - the goal is to adapt the existing rules to fit the novel financial instruments and grant crypto-engaged companies the freedom to innovate and continue growing. For example, MiCA will complement the EU’s existing Anti-Money Laundering Directive (AMLD) by providing a specific regulatory framework for crypto-assets.

The majority of the enforcement process will be handled by national regulators, following the common union-level rules.

MiCA in a nutshell

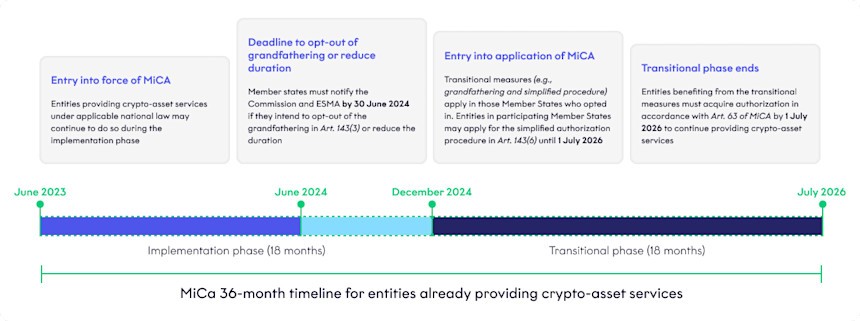

When: MiCA came into force in June 2023 with an 18-month implementation phase, followed by an 18-month transitional phase ending in December 2026.

Who: companies that issue, trade, and provide custodial or advising services for crypto assets.

What: crypto assets that aren’t covered by existing regulation, including asset-reference tokens and e-money tokens (a.k.a. “stablecoins”).

Why: to improve market stability by ensuring transparency, disclosure, and supervision of transactions and preventing money laundering and terrorist financing activities.

How: the regulation’s common rules will cover the 27 EU countries but national regulators will, in practice, do most of the enforcement.

The full text is available here.

Potential advantages and disadvantages of MiCA

If you are a company that offers or plans to offer crypto services within the EU, you must be authorized by one of the EU’s 27 national financial regulators.

On the bright side, this will allow you to explore a market with 450 million prospective clients through a single license. Thanks to MiCA, the EU will have a single authorization system enabling you to provide services to the entire bloc.

Furthermore, European oversight authorities have left national regulators a certain degree of freedom in how they apply the rules, at least at first. This will allow EU states to compete in attracting crypto business. For example, France is already making strides in crypto regulation, attracting some of the biggest names in the industry and positioning itself as the leading EU crypto hub.

Last but not least, MiCA will introduce much-needed certainty about the rules of the game - something that Binance’s CEO has welcomed (unironically). This is very positive since the recent history of the crypto industry has shown that a game without rules is pure chaos from which nobody benefits.

If you are wondering what’s at stake if you don’t comply with MiCA, the short answer is - a non-compliance penalty can be as high as 15% of your annual turnover.

At the same time, the rules that crypto-engaged companies must meet to be compliant can seem challenging, complicated, and unclear. If that is the case for you, we are here to help.

Fourthline helps you balance MiCA compliance and business growth

The crypto niche is facing a unique set of challenges. On one hand, it has been shaken by controversies that have further fueled the excessive market volatility of the past few years. On the other hand, there are the upcoming regulations to be understood and complied with.

However, with the right partner by your side, you can turn compliance from a complicated yet unavoidable exercise into a competitive advantage. And the sooner you embrace upcoming regulations as the once-in-a-lifetime opportunity that they are, the better your starting position once they are enforceable.

Ensuring seamless compliance and streamlined market expansion - mission possible

Crypto-engaged businesses are growth-focused, aiming to expand to new markets as quickly as possible. Even regulators admit that crypto businesses often grow “much faster than the compliance apparatus.” However, this doesn’t mean that the long hand of the law won’t catch up. Just the opposite; organizations should be keeping a close eye on the regulatory changes and be prepared to make the most out of them.

The first step to success is to obtain a license to operate across the EU market. While you can do that in virtually any member country, different jurisdictions will have different procedures.

Did you know? There are signs that MiCA might inspire global regulators to follow the EU’s example. Officials from the US Congress, as well as UK authorities, have already started collaborating with Brussels for know-how and regulatory tips for digital assets.

Opportunity: The sooner you get onboard with MiCA, the better positioned you will be for seamless expansion should similar regulations come into force in non-EU markets.

In that sense, it is important to be aware of the specifics of each market to ease the process for you and your clients. However, MiCA isn’t the only EU legislation that affects the crypto sector (laws covering money laundering, tax avoidance, cybersecurity, distributed ledger technology-based security trading, and more are also applicable), nor is it the last. Keeping tabs on all the regulatory changes is a daunting process, with a high risk of something slipping through the cracks.

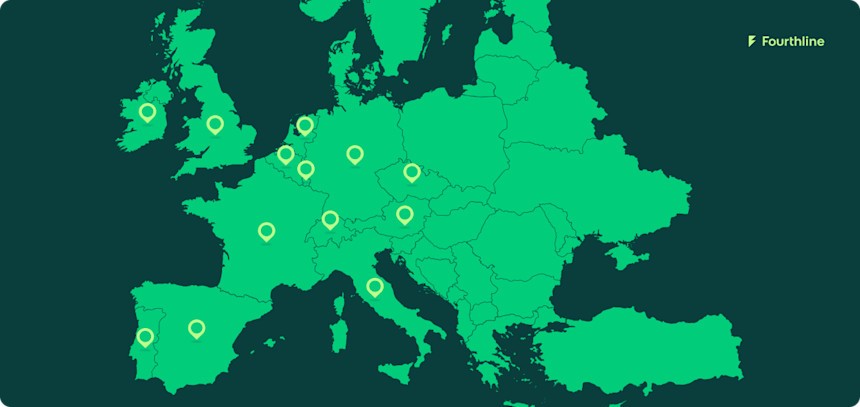

Fourthline’s compliance solutions help you remain on top of Union-level and local regulatory requirements in various markets, including:

- Austria

- France

- Germany

- Italy

- Netherlands

- UK

- Spain

- The rest of Europe & beyond

In an interview for “The Total Economic Impact™ Of Fourthline”, a commissioned study conducted by Forrester Consulting on behalf of Fourthline, one COO and head of KYC at a fintech organization shares: “Before Fourthline, entering a new region was a long, drawn, tedious process taking anywhere between one to three months. Since implementing Fourthline, thanks to their existing reliance agreements and local expertise, we have added three new markets in less than two months, with further launches already in the pipeline.”

Turning compliance into a cost-efficient process

The crypto market is often a realm of extremes. At the start of 2022, crypto companies had some of the world’s most famous sports arenas named after them and were spending big on Super Bowl ads featuring Tom Brady and Matt Damon.

Then, in the span of just a year, notable players like FTX, Three Arrows Capital, Celsius, and Genesis went bankrupt. Paired with interest rate hikes, this pummeled the crypto market. Its overall value plummeted from $3 trillion in November 2021 to $796 billion at the end of 2022.

While in 2023, the market regained some ground, many crypto-engaged companies, especially those with significant holdings in crypto assets that managed to survive the onslaught, have been forced to rethink their expenditures and shift to a more cost-conscious business approach.

With MiCA coming into force, regulatory compliance will become another necessary and unavoidable cost item for companies. However, with Fourthline’s suite of compliance solutions, you can keep compliance costs to a minimum and channel the savings to where they are most needed.

Trusting Fourthline to help you build your compliance processes will ensure you have industry-leading technology with seamless integration and minimum implementation efforts and training costs. A single API will cover all your compliance needs.

Furthermore, thanks to our modular approach, you can choose only the compliance solutions you need. Whether it is document verification during client onboarding, re-KYC, or continuous AML monitoring, you can design partial or end-to-end compliant flows that scale as you grow. This flexibility is invaluable in a world of ever-changing regulations and market uncertainty.

The fintech companies interviewed by Forrester Consulting report that adopting our compliance solutions has helped them ensure a 390% ROI with a payback period of under 6 months. On top of that, they gained $13.3 million worth of improved organizational efficiency and $2.7 million worth of reduced fraud exposure.

Designing seamless onboarding flows for increased customer satisfaction

The recent market developments have turned the crypto industry into a battlefield where the competition for every client is growing fiercer by the day.

Nowadays, clients want a seamless onboarding experience where they don’t have to endure long verification wait times or provide tons of personal information and documentation. Statistics reveal that failure to ensure a smooth onboarding process translates to a 68% risk of losing your client to a competitor. Moreover, these dissatisfied customers are more likely to voice their concerns through negative reviews.

Losing a client at the door of your organization due to poor onboarding procedures won’t only leave a bittersweet taste, but it also bears financial and reputational risk. On the other hand, prioritizing customer satisfaction will prove invaluable for strengthening your position in an ever-more competitive industry.

“For all crypto businesses that struggle to balance compliance and customer satisfaction, Fourthline has simple advice: Build seamless onboarding flows to reduce friction and maximize conversions,” says Niall Grant, Head of Compliance at Fourthline.

Fintech organizations interviewed by Forrester Consulting report that our compliance solutions have helped them ensure $10.4 million worth of improved conversions.

The key to this massive gain is the significantly improved speed and accuracy of verification, which was valid even for organizations that already used digital tools or in-house solutions. This optimization proved highly important for their clients, leading to lower abandonment rates and improved conversions. According to Forrester’s estimations, fintech organizations that have deployed our solutions experienced a 30% increase in conversions, 90% of which were attributed directly to Fourthline.

“Fourthline is great when it comes to validating photo identification and security features even when the quality of photo or documentation is not good, thereby avoiding unnecessary delays and checks which ultimately results in higher conversions and better onboarding experience for our customers,” one director of product management and operations at a fintech organization shares.

“We used to have a poor track record of conversions as there was a lot of paper-based validation required, especially in countries like France and Spain. But with Fourthline’s automated, AI-driven verification checks and their know-how of the local country-specific requirements, we have experienced a 25% improvement in customer conversions,”adds a head of KYC and AML at a fintech bank.

Lean on Fourthline to embrace MiCA

The sole purpose of MiCA is to put an end to the perception of the crypto industry as the Wild West and pioneer the global effort towards regulating the niche.

Crypto-engaged companies that act proactively and start preparing for the legislation today will be in the driving seat of the healthier, more transparent, and secure crypto industry of tomorrow.