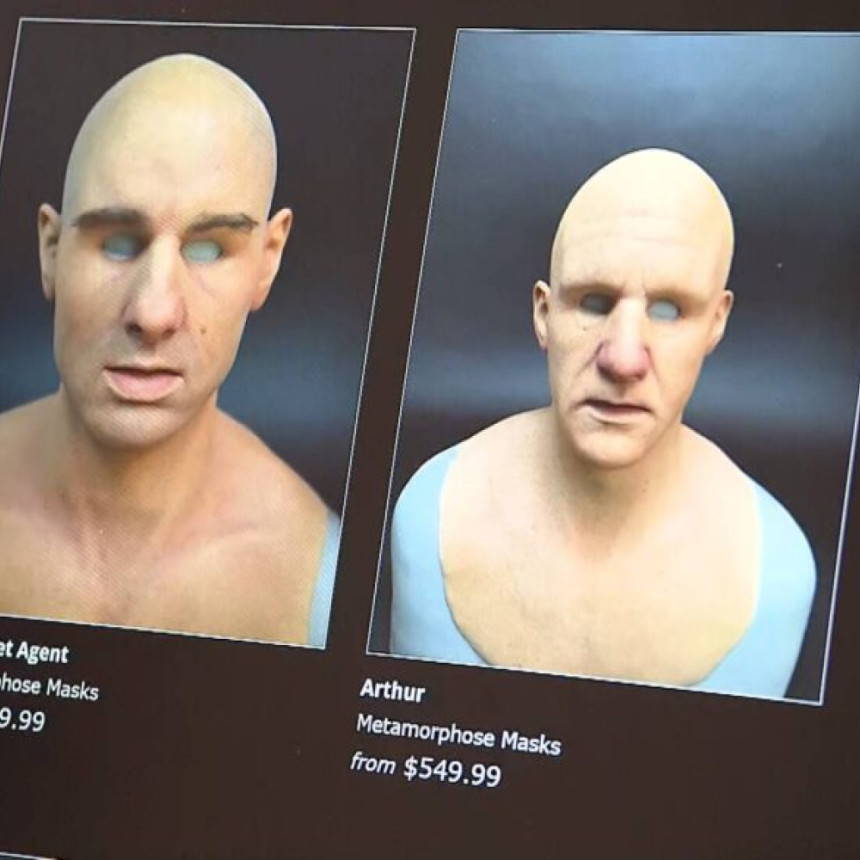

Social engineering attempts increased by 37% in Q2 2021 compared to Q2 2020. Social engineering represents 47% of all financial fraud attempts; 53% is ID and document fraud (Q2 2021). Criminals are increasingly convincing unsuspecting people to take selfies, videos, and photos to open fraudulent accounts – assisted selfies increased by over 19 percent in Q1 2021 compared to Q1 2020. Elderly and young people are the main targets of financial fraudsters (19.9% of people aged 61+ were ‘assisted’ in attempting to open a bank account).

How humans get hacked